The Database Market Shake-Up

For at least a decade, market shares in the commercial database marketplace have remained about the same. The “Big Three” database vendors predominate – Oracle, IBM, and Microsoft. Expressed as a ratio, their relative market shares are:

| Oracle | : | IBM | : | Microsoft | : | All others |

| 2 | : | 2 | : | 1 | : | 1 |

Oracle and IBM have fluctuated between about 30 and 40 percent of overall database market revenue, while Microsoft’s SQL Server ranges between 10 and 20 percent. All other commercial products are usually pegged at under 15 percent in total. (For exact estimates, click here for numbers from IDC or here for Gartner Group statistics.)

Now here is what is interesting: After all these years of stability, the database market faces a major upheaval.

Open source software has greatly impacted such areas as operating systems and Web servers, but its impact on database software in IT organizations has been minor up to this time.

No longer. MySQL AB claims that its new MySQL Version 5.0 has been downloaded over 6 million times between October 2005 and March 1, 2006. Sleepcat Software claims that there have been more than 200 million deployments of its open source Berkeley DB database. PostgreSQL 8.0 was downloaded over one million times in its first seven months of availability. (For a quick overview of the major open source databases, see my previous DBAzine article “Capitalizing on Open Source Databases.”)

Yikes! These are big numbers, by anybody’s measure. Even allowing for discrepancies between the number of downloads and the number of actual users, it’s evident that the major open source DBMSs are flooding the marketplace.

How will this affect the competitive landscape for commercial databases? What are Oracle, IBM, and Microsoft doing to counteract their new, open source competition? This article explores these questions.

First we’ll look at express databases, the free database editions with which the Big Three hope to challenge open source databases head on. Then, we’ll talk about Oracle, IBM, and Microsoft individually, and discuss how each positions itself in the face of the open source onslaught.

Introducing Express Databases

The Big Three commercial database vendors hope to counteract open source databases through their new express databases. These are free, licensed editions of Oracle, DB2 UDB, and SQL Server. They are the vendors’ flagship databases, but with the following scalabilty limits:

| DB2 UDB Version 8 Express-C |

Oracle Database 10g Express Edition (also known as “Oracle Database XE”) |

SQL Server 2005 Express Edition | |

| Processors maximum | Up to 2 CPUs (dual or single core) |

1 CPU | 1 CPU |

| Memory maximum | 4GB | 1GB | 1GB |

| Data Size maximum | No limit | 4GB “user data maximum” |

4GB “maximum database size” |

| Vendor’s description of limits | here | here | here |

Table 1: Express Edition scalability limits.

You can freely download, install, develop with, deploy, and run express databases. And, you can use them for development or for running “production” database applications, without paying a dime.

The express databases are “real” Oracle, DB2 UDB, and SQL Server. They have the same database engines and features as the vendor’s other product editions. However, the express products exclude various advanced or specialized database features. For example, the express editions exclude the “connection concentrators” the databases offer to support very large numbers of concurrent users. Express editions lack other features the vendors consider high-end or special-purpose.

Since the express databases are free versions of the vendors’ flagship database products, you can use them for many real-world tasks. Here are a few ideas:

- For use as a free database for developers on their PCs and laptops

- For use as a production DBMS for departmental applications

- For prototypes and smaller projects that may later grow

- For use as no-cost alternative to open source databases

- For use as an embedded database

- For try-before-you-buy evaluation

- For staff training and certification

- For standalone applications requiring a database

- For departmental data marts

Think about that list for a moment – if you are an Oracle, DB2 UDB, or SQL Server customer today, your organization can save a ton of money by shrewdly deploying these express editions. I recommend you gather your team for a brainstorming session or even develop a formal plan to fully take advantage of the new express databases.

The scalability chart shows that IBM’s express database scales a bit higher as a free product than Oracle and SQL Server. DB2 UDB Express-C takes advantage of up to two processors (dual or single core) and four gigabytes of memory. The Oracle and Microsoft products can utilize one CPU and up to one gigabyte of memory. They also have data sizing limits of four gigabytes.

All the express databases will run on computers with more resources than their “limits,” they just won’t take advantage of those extra resources when running.

Let’s probe deeper into what the express databases are about. The following chart provides further comparison:

| DB2 UDB Version 8 Express-C |

Oracle Database 10g Express Edition (also known as “Oracle Database XE”) |

SQL Server 2005 Express Edition | |

| Platforms | Linux and Windows (32- and 64- bit) |

Linux and Windows (32-bit) |

Windows (current versions with required SPs only) |

| Required Software | None | None | Internet Explorer 6.0 SP1 or later, and .NET Framework 2.0 or later |

| Introduced | Jan 2006 | Feb 2006 | Nov 2005 |

| Seamless Upgrade to Other Editions | Yes | Yes | Yes |

| Application Development Express Editions | WebSphere Application Server Community Edition, Zend Core, Visual Studio 2005 add-ins, Migration tool, others | JDeveloper, Oracle SQL Developer, Zend Core, Visual Studio .NET tools, Migration Workbench, others | Visual Studio Express Editions – free until 11/7/2006 |

| Product Home page | Here | Here | Here |

| Download Page | Here | Here | Here |

| Forums (run by the vendors) | Here | Here | Here |

Table 2: Express editions compared.

Oracle and IBM offer their products under Windows and Linux. Microsoft supports only Windows, and at that, only recent Windows versions with current Service Packs. Microsoft’s express database also requires Internet Explorer and .NET as prerequisites. (The product home pages give full details on system and platform requirements.)

All three vendors support seamless upgrades from the express databases to more scalable purchased editions of their products. This is the whole idea, of course – the Big Three hope that generously providing free products on the low end will result in paying customers as databases grow and needs increase. I believe this as a true win-win for these vendors and their customers. Certainly, customers benefit in that they can use the free versions of the high-powered commercial databases for projects like those we listed.

All three commercial database vendors support a slew of free developer tools. The goal is to offer a comprehensive package for developing database applications. Their strategy is not limited to free databases, but encompasses database application development.

Oracle and IBM offer free express editions of their commercial developer environments. Examples include WebSphere from IBM and JDeveloper from Oracle. The two companies also support open source products like Zend Core and the Eclipse framework for Java developers. They also support Microsoft’s commercial tools, Visual Studio and .NET. So Oracle and IBM support free versions of their own commercial development tools and also the major open source tools.

Microsoft takes a fundamentally different approach. As revealed in EWeek’s cover-story evaluation of SQL Server 2005, Microsoft mated SQL Server 2005 to its proprietary development toolset. From Microsoft’s standpoint, open source development tools are competitive to their own offerings. Microsoft thus offers free express editions of its own Visual Studio products. This offer stands until 11/7/2006, after which time pricing will be imposed for subsequent downloads.

The links to the express database home pages above provide full details on all three vendors’ development environments.

The Express to Success?

Opinions differ on how successful the Big Three will be with their express databases against open source databases like MySQL and PostreSQL. Some think the products from Oracle, IBM, and Microsoft will win this competition because they are more sophisticated and have more features. They also offer more add-on products to leverage the databases for data mining, warehousing, business intelligence, and other data-centric applications.

IT organizations already using commercial databases will probably like the idea of bringing in free versions for small projects, rather than bringing in new and unfamiliar open source databases to save money. They’ll definitely like not paying for developer databases on the desktop. And seeding the packaged software marketplace with free databases for solutions development and product distribution looks like a winner.

Open source advocates have a different take on this competition. They don’t see the Big Three as making much headway against the explosion of open source software. Many believe that the open source model’s “inherent advantages” will ultimately lead to its triumph. They see open source products as leading a revolution in the database market that will topple the Big Three from their perches. They emphasize that the Big Three’s new express databases are not open source products, but rather “no cost licenses” for proprietary database products.

My view? I love making predictions, but don’t dare guess how this ball will bounce. The express databases were just recently introduced. A year from now we’ll have some real data to see how this competition is shaking out.

Vendor Strategies

Let’s take a look at the recent actions of the major commercial database vendors. This quick overview surfaces some useful information on how the vendors are responding to the open source challenge.

Oracle

According to its Annual 10K Reports, roughly 80 percent of Oracle Corporation’s annual revenue comes from software. The other 20 percent comes from services. Open source software clearly challenges Oracle’s traditional revenue stream.

Perhaps for this reason, Oracle embarked on a massive acquisitions binge two years ago. The company has spent nearly 19 billion dollars purchasing about 20 software vendors. Some were traditional vendors, while others were open source. Of interest to us, of course, are the database acquisitions.

One of Oracle’s purchases was TimesTen Inc., the vendor of the commercial TimesTen database. TimesTen supports in-memory databases for real-time data caching and extremely fast dynamic queries. TimesTen might be considered a niche database whose strengths complement Oracle’s flagship database.

Oracle also purchased two open source database products. Oracle bought Sleepycat Software and its product Berkeley DB, the most widely-used open source database for embedded applications. Berkeley DB is very popular for applications where developers view the database as a set of Application Programming Interfaces (APIs). Such applications preclude the use of “traditional” databases that require memory-resident processes that persist across API calls. Berkeley DB is useful for software embedded in specialized devices or consumer products with embedded intelligence.

Oracle Corporation states that it intends to continue to offer Berkeley DB in its current dual-license model. The dual-license model offers both a free open source license and a commercial license that comes with vendor support. Customers pick which license they need based on their intended use of the product. Companies like Sleepycat Software make money from their open source products with this model.

Oracle also tried to purchase the most widely-used open source database, MySQL. While this bid failed, Oracle did purchase Innobase Oy, the Finnish company that develops InnoDB software. The MySQL database uses several different underlying “engines,” or data access drivers, the most popular of which for transactional systems is InnoDB. Oracle Corporation thus has acquired a key component underlying the most popular open source database, MySQL. (MySQL users can also employ the Berkeley DB engine but it’s not nearly so popular as InnoDB.)

What does all this mean? Some analysts take a cynical view. They believe that Oracle Corporation is buying the open source database competition to destroy it. They base this belief on their allegation that Oracle Corporation has engaged in this behavior in the past.

I think a more likely scenario is that Oracle is trying to broaden its software revenue model from solely commercial product into a mix of proprietary and open source components. Support and subscription services are the most lucrative parts of the open source model. These match Oracle’s core strengths in the support and services sector. Oracle is probably betting that they can evolve into a company that makes money from both open source and commercial products.

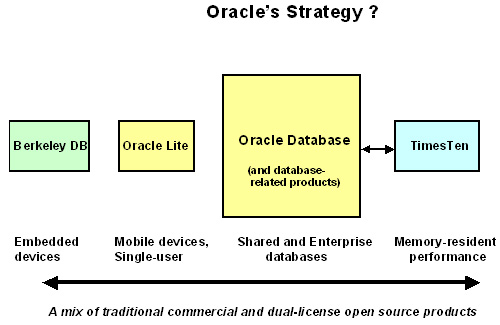

Oracle’s database acquisitions expands their product line into new, complementary areas. The following diagram shows how TimesTen technology complements and broadens Oracle’s reach on the high-performance end, while Berkeley DB extends the company beyond their Oracle Lite edition into the new low end of embedded device programming:

Oracle’s corporate acquisitions started only 18 months ago. We’ll have to wait for the company to digest these purchases before more solid information emerges to shed light on the company’s strategy.

IBM

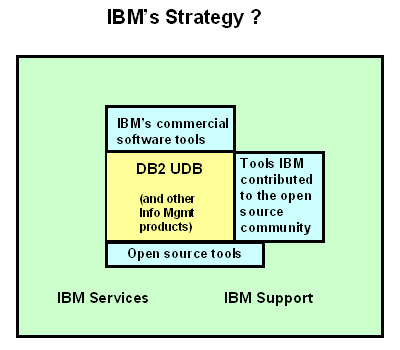

IBM has long led the Big Three in the open source arena. IBM’s annual report for 2004 states the company’s philosophy– “Central to IBM’s approach for building value in the infrastructure category is its support of open standards and its active promotion of Linux and other open source platforms, which help IBM’s clients control costs and allow them to benefit from the latest advances created by development communities around the world.”

This strategy makes sense because less than 20 percent of IBM’s annual revenue comes from commercial software. In contrast, IBM’s services revenue nears 50 percent. It’s no accident that IBM has contributed a ton of software to the open source community. Examples include the Eclipse framework, the Derby database, the Rational Unified Process for design, Java tools, and many others. IBM contributed over 500 of its patents to the open source community last year. The company helped found many of the major open source foundations, including the Open Source Development Lab, the Apache Software Foundation, the Eclipse Foundation, and the open-source storage consortium Aperi.

IBM welcomes the trend towards open source software. The company’s strategy mixes traditional commercial and open source software components, with the bulk of its revenue derived from services for development and support with these tools. IBM is the most “open source friendly” of the Big Three commercial database vendors.

In the database arena, IBM promotes DB2 UDB as the industrial-strength “database centerpiece” around which customers can apply and deploy open source development tools. And if customers need some help with all that new software? IBM Global Services has the skills and is awaiting your call.

Microsoft

Microsoft is perhaps the most challenged of the Big Three by the open source phenomenon. While the company does not break down their revenue into the traditional triparate of “hardware, software, and services,” most analysts agree that Microsoft is the most dependent of the Big Three on income from commercial software sales. For all Microsoft’s attempts – and their increasing success – at diversification, right now the company’s revenue is still driven by software sales.

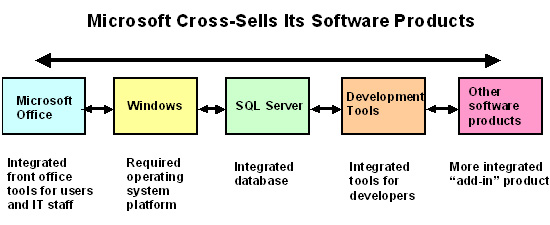

Microsoft’s success as a software company relies on cross-selling to generate software revenue. Cross-selling means that Microsoft gains customer access with one category of product and then sells that customer other products in other categories. Cross-selling is based on two principles:

- Integration – Software components are tightly integrated, ideally so integrated that customers cannot disentangle themselves from the vendor’s “software web” of integrated packages. Software components often require other components as prerequisites.

- Exclusivity – The vendor’s software bundle is complete and addresses all user needs. Coupled with its tight integration, this makes it exclusive of all outside products and “locks out” competing products.

Understanding Microsoft’s marketing strategy explains why you must install Internet Explorer and the .NET framework to install SQL Server 2005 Express Edition. It also reveals why you can only install the product under Windows XP if it has Service Pack 2 installed. Marketing drives these requirements, not technical needs.

This explains why SQL Server runs only on Windows. Despite speculation on the Web to the contrary, I wouldn’t look for SQL Server to show up on Linux anytime soon.

The following diagram illustrates Microsoft’s cross-sell strategy:

This strategy explains why Microsoft tied SQL Server 2005 so inseparably to their commercial development tools. It’s getting hard to tell where Visual Studio and .NET begin and SQL Server ends. If you’re a DBA in a SQL Server shop, it’s time to trade in your Java manuals for some Visual Studio and .NET guides. Skills with Microsoft products will be much more valuable to your work than knowledge of non-Microsoft software.

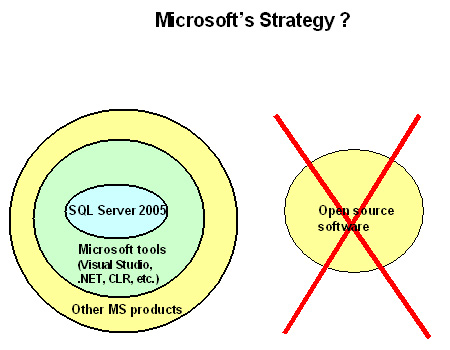

Is there a role for open source software? Not in Microsoft’s view. As the company’s 2005 annual report states, “... the popularization of the non-commercial software model continues to pose a significant challenge to our business model ...”. Microsoft lists this threat as first of the two dozen risks to its business in its annual report.

My friends who are open source enthusiasts argue that Microsoft is swimming against the tide. They argue the company is facing an oncoming tidal wave in the open source movement, and that Microsoft will be swamped in failure.

I have a different view. Market share statistics for SQL Server from IDC and Gartner Group over the past several years show that SQL Server continues its strong revenue growth. The product increases its share of worldwide database revenue every year – in spite of the burgeoning open source movement. Even as Microsoft makes proprietary SQL Server by inseparably intertwining it with Microsoft’s expensive development tools, customers continue to buy in.

Clearly many customers believe that Microsoft offers a superior integrated development environment (IDE) anchored by an excellent database. I believe Microsoft will continue to prosper from this perception.

The downside is that Microsoft’s proprietary world will become increasing distinct and self-referential (even isolated) from the software mainstream. Where Microsoft once drove the masses of developers, the company’s technologies will become a market alternative, and likely a secondary one. Microsoft’s proprietary software will continue to please its customers and remain a profit center for Microsoft, but it will become ever less relevant to those outside its reach.

Your View?

This article started by introducing the new express databases offered by Oracle, IBM, and Microsoft. These vendors position their express products as alternatives to open source databases. They hope express databases become vehicles for customers to grow into their commercial products.

The article then branched out into a more speculative realm, trying to divine the open-source strategies of the Big Three commercial database vendors. Ultimately you’ll form your own judgments on how Oracle, IBM, and Microsoft are positioning themselves and what the companies offer. Log in and add your comments below! I hope this article stimulated your thinking.

--

Howard Fosdick is an Oracle-certified DBA and a IBM-certified DB2 DBA. His new book Rexx Programmer’s Reference covers everything about Rexx including database programming, interfaces, interpreters, and object-oriented Rexx.

Contributors : Howard Fosdick

Last modified 2006-07-14 02:11 PM

Replies to this comment